Key notes:

- Due to the timeframes to complete individual income tax returns, the March 2021 financial year data is not available yet.

- The new 39% income tax rate was introduced on April 1st, 2021, so will increase the % of tax paid by higher income earners in new data released.

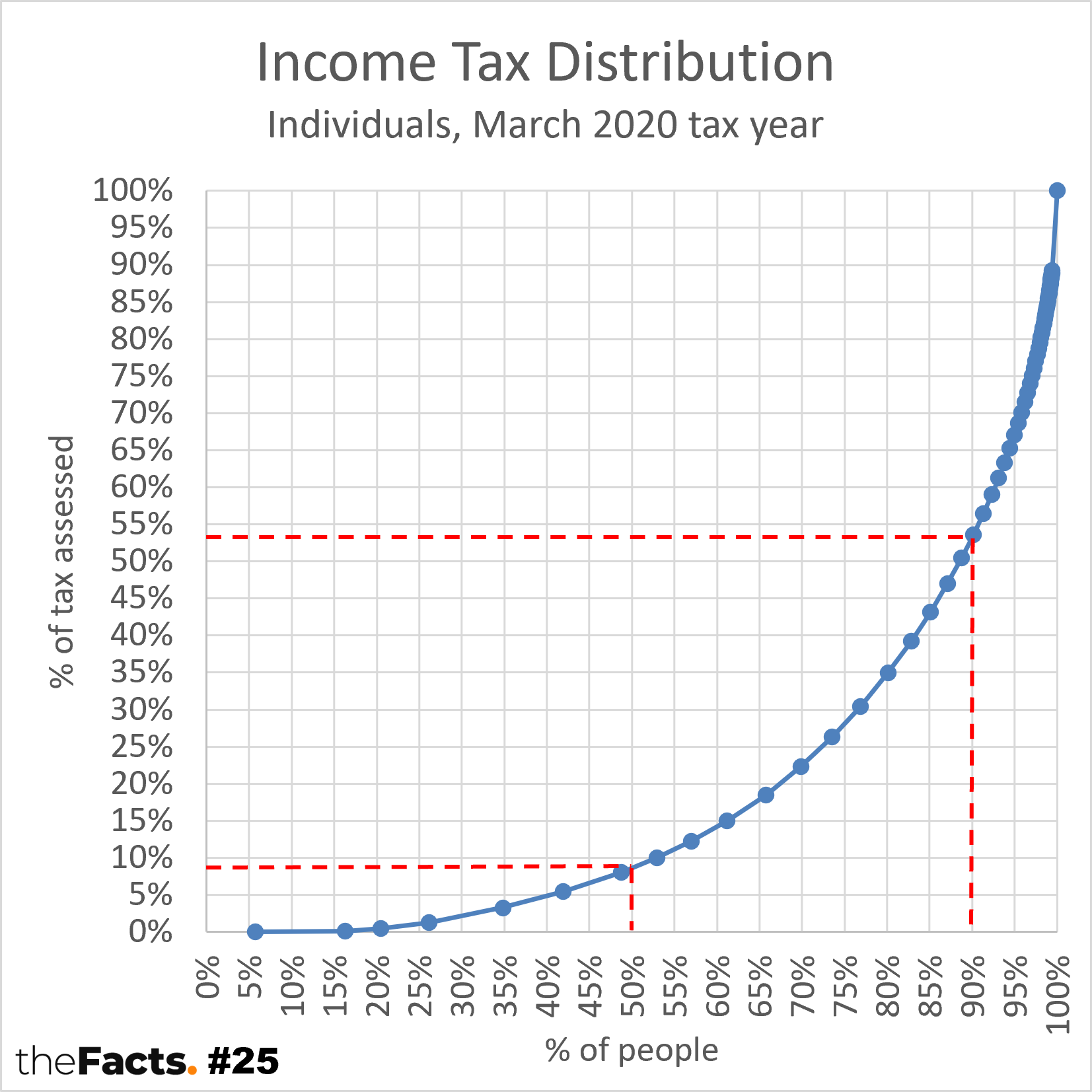

Key highlights from 2020 FY:

- The top 10% of income earners ($95k+) paid ~50% of total individual income tax

- The bottom 50% of income earners (~$31k) paid ~10% of total individual income tax

Some common cumulative data points:

| Taxable income | Cumulative people | Cumulative tax assessed | Inverse interpretation (rounded where helpful) |

|---|---|---|---|

| Up to $10k | 20.5% | 0.5% | The top 80% of income earners pay 99.5% of income tax |

| Up to $15k | 26.2% | 1.3% | The top 74% (~3/4) pay 99% |

| Up to $20k | 34.8% | 3.3% | The top 65% (~2/3) pay 97% |

| Up to $25k | 41.9% | 5.4% | The top 58% pay 95% |

| Up to $35k | 52.9% | 10.0% | The top 47% (~half) pay 90% |

| Up to $55k | 69.8% | 22.3% | The top 30% pay 78% |

| Up to $70k | 80.1% | 35.0% | The top 20% pay 65% (~2/3) |

| Up to $95k | 90.2% | 53.6% | The top 10% pay 46% (~half) |

| Up to $125k | 95.0% | 67.0% | The top 5% pay 33% (~1/3) |

| Up to $155k | 97.1% | 75.1% | The top 3% pay 25% (~1/4) |

| Up to $185k | 98.1% | 80.2% | The top 2% pay 20% |

| Up to $300k | 99.4% | 89.2% | The top 0.5% pay 10% |

…

Are these individual income tax rates:

a) fair

b) too high for lower income earners

c) too high for higher income earners

d) too high for everyone

e) a broken model, and there’s a better tax system?

…

Have your say

…

Other notes:

- This data is about individual income tax. It does not include company tax, GST, or any discussions about possible asset taxes.

- We choose the 10:50 and 50:10 rule as:

- Simple, round numbers are helpful for comprehension

- It is a powerful memory hook to retain this knowledge

- We felt it worked better than 80:35 and 35:80, or 75:30 and 30:75, or 60:15 and 15:60

- Other percentage points didn’t have this mirroring effect

- IRD notes:

- These tables show estimates of the number of individuals in bands of taxable income up to $250,000 (for 2001-2008-09), and up to $300,000 (from 2009-10 onwards). It also shows aggregate taxable income and income tax for people in each income band.

- The income and tax information is derived from IR3 tax returns, personal tax summaries (to 2017-18), automatic income tax assessments (from 2018-19) and employer PAYE information.

- Data for the current tables was extracted from Inland Revenue systems on 14 December 2021. This release revises previously released information for all years from 2015-16 onward.

- Because taxpayers have a year to file income tax returns if represented by a tax agent, these distributions are released with a lag. The 2019-20 table is now complete, but 2020-21 is not yet complete and will be included in the next release.

- The data in all tables up until and including 2014-15 was based on a random sample and has been scaled up to population estimates. The sample was 10% of IR3 filers and 2% of other taxpayers. From 2015-16 onward population data is now used.

- There has been a structural break in the coverage of this data from the 2018/19 income year. The effect has been to increase the number of people covered by the tables, particularly those who earn only passive income, as indicated in the table below.

- Taxable income for individuals is income on which their personal income tax is assessed for the March year. This is income from all taxable sources being assessed less allowable deductions and losses. People with negative income because of losses are recorded as having nil taxable income in the tables.

- Income coverage in the tables has changed from 2018-19, as indicated in below:

- Up until 2017-18, for people who are non-filers, taxable income was assumed to be (limited to) their total PAYE gross earnings in the year ended 31 March. This calculation did not include interest, dividends, KiwiSaver, or other PIE earnings. From 2018-19, these income streams are included (although for PIEs it is only if the PIE income was taxed at the wrong rate).

- From 2018-19, the inclusion of additional people with passive-only income such as interest, dividend, and PIE income will have changed the overall distribution by introducing more low income earners, particularly children. Moreover, other people will now have bigger incomes through the inclusion of additional income streams from their investments. This is particularly true of people who did not previously file a tax return or receive a personal tax summary.

- Income tax for individuals is calculated based on their taxable income. The table displays income tax before any allowances for tax credits such as imputation credits or Working for Families tax credits. The low income rebate (to 2008-09), independent earner tax credit (from 2010) and tax rebates on the IR3 and personal tax summary are applied, but the calculation does not include the donations, housekeeper or redundancy rebates.

- For people who are non-filers (2017-18), income tax is calculated as if they had instead filed an annual return. From 2018-19 such people will have an automatic annual assessment.

- All numbers are provisional and subject to revision.

Thank you to the Factors who helped pull this together.

…

SOURCE:

https://www.ird.govt.nz/about-us/tax-statistics/revenue-refunds/income-distribution

Data published by Inland Revenue

(c) Crown Copyright

Licensed for use under the creative commons attribution licence (BY) 4.0

…

Did we make a mistake, or have you got smarter data? Let us know.